International Student Insurance

International Student Insurance

For students studying in the UK

For year-round adult centres or Family Courses, the insurance is optional and can be purchased during course booking for £5.92 per student per week, including Insurance Premium Tax. This rate applies to bookings from 1st September 2023 until 31st August 2024 and may be subject to change after that.

Insurance must be purchased before your arrival in the UK and is recommended at the time of booking to ensure coverage for cancellations. The cost is included in your course deposit. If you opt not to use our insurance, you may need to show proof of an alternative policy.

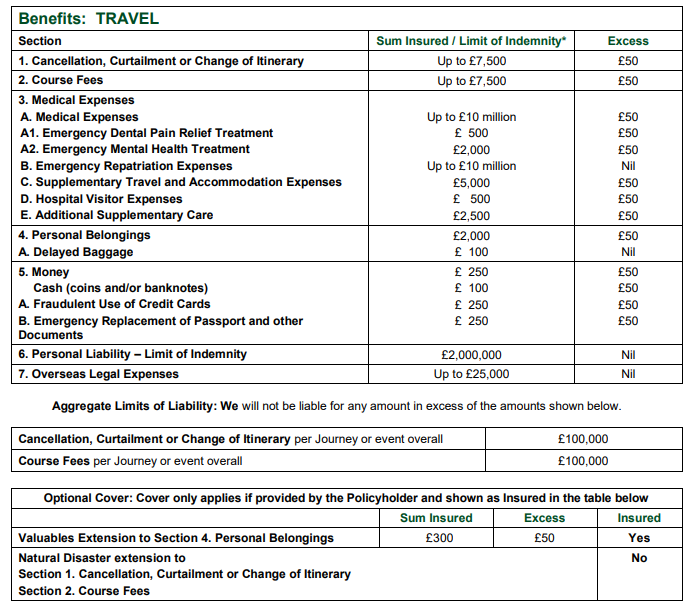

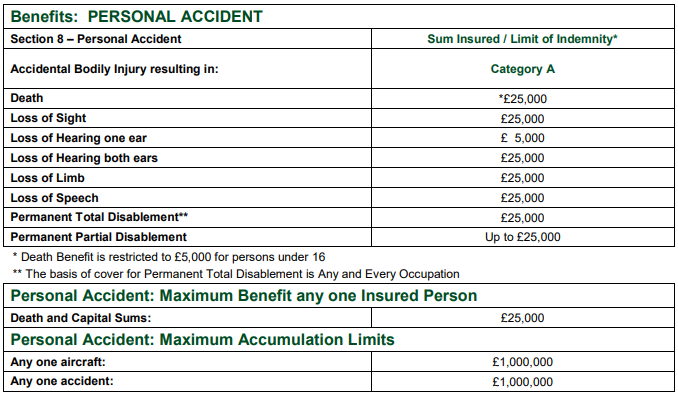

Please view the documents below if you wish to read the full details of the policy:

Immigration Health Surcharge for the UK:

For students studying in the UK for over 6 months, a healthcare surcharge can be paid during the visa application process, granting access to healthcare. Student information is shared with the NHS upon payment and visa approval. Healthcare in the UK requires the presentation of a biometric residence permit.

Further details can be found on the UK visa website here.

For students studying in Canada

St Giles International has partnered with ‘GuardMe’ to provide insurance for students booking a course at St Giles in Canada.

If you are studying at a year-round adult centre, the insurance policy is optional and can be purchased when you book your course with us for CAD$18.50 per week.

Booking a course with St Giles International in Canada requires the purchase of sufficient insurance for your stay. Our insurance is available at the time of enrolment and is included in your course deposit.

Opting out of our insurance may necessitate providing proof of an alternative insurance policy.

Please view the Policy Brochure below to read the full details of the policy:

Once you have purchased insurance from us, you will receive confirmation by email within two weeks, and gain access to our insurance Student Zone where you can learn more about the healthcare system in the country of destination.

Details of this cover:

|

Coverage |

Up to $2,000,000 |

|

Web based functionality |

Enrolment, claims adjudication and payments. |

|

Claims procedure |

Turnaround of 7 days |

|

Language |

Multi lingual help is available 24/7. |

|

Exclusions |

|

|

Cancellations |

No cancellation fee. |

|

Services |

Keep me safe (Mental health) App available with details of medical insurance COVID coverage (https://www.guard.me/covid-19.php) Doctor Please! (Additional free access to remote medical consultation, medical advice & treatment options) |